It has been almost two and a half years since the United Kingdom signed its post-Brexit trade deal with the European Union (EU), which was expected to have multifaceted impacts on the UK economy. The EU-UK Trade and Cooperation Agreement (TCA) was signed on 30 December 2020 and came into effect provisionally on 1 January 2021. Leaving the EU’s Single Market and the EU Customs Union represented a profound change in the economic relationship. This change was expected to have an impact on trade flows between the EU and the United Kingdom, but also on migration flows, foreign direct investment, regulation, the financial sector, science and education, and other areas of the UK economy.

While it will take some time for all the effects to emerge, this article focuses on recent developments in UK trade and labour markets, where the impacts of Brexit have been widely discussed. The coronavirus (COVID-19) pandemic is a confounding factor, but the available data allow a first stocktake of the effects of Brexit. While significant uncertainties regarding the precise magnitudes remain, the available evidence suggests that Brexit has been a drag on UK trade and has contributed to a fall in labour supply, both of which are likely to weigh on the United Kingdom’s long-run growth potential. [1]

While the pandemic and supply chain disruptions have affected trade globally over recent years, Brexit had an additional impact on UK trade. The global recession and subsequent recovery in the wake of the pandemic, together with disruptions in global supply chains, have generally increased trade volatility globally over recent years. For the United Kingdom, the extensive and drawn-out negotiations on the withdrawal arrangements and on the future trading relationship generated even greater uncertainty, as also reflected in a sharp depreciation of the country’s exchange rate, which had already negatively affected investment, imports and exports during the period before the United Kingdom’s formal exit from the EU. [2] The United Kingdom’s investment growth rate was low long before Brexit, which also underlies the United Kingdom’s stagnating productivity growth. Following the Brexit referendum, a prolonged period of uncertainty about the EU-UK relationship further dampened investment. Exports have also been affected by the reduced attractiveness of the United Kingdom as an investment destination for foreign companies. [3]

Since January 2021, EU-UK trade has been governed by the EU-UK TCA, which formalised the trade and regulatory relations. The TCA ensures zero tariffs and zero quotas on goods traded between the EU and the United Kingdom. To qualify for tariff-free access, however, UK goods need to meet rule-of-origin requirements, which are set out in detailed annexes to the TCA. Thus, unlike in the Single Market, companies face additional administrative burdens and delays at the border owing to customs and regulatory checks. The United Kingdom and the EU have implemented the agreement at different speeds. While EU countries immediately applied full customs requirements and checks on imports from the United Kingdom, the United Kingdom delayed the introduction of full customs requirements on UK imports from the EU until January 2022, with additional health, safety and security checks delayed until the end of 2023.

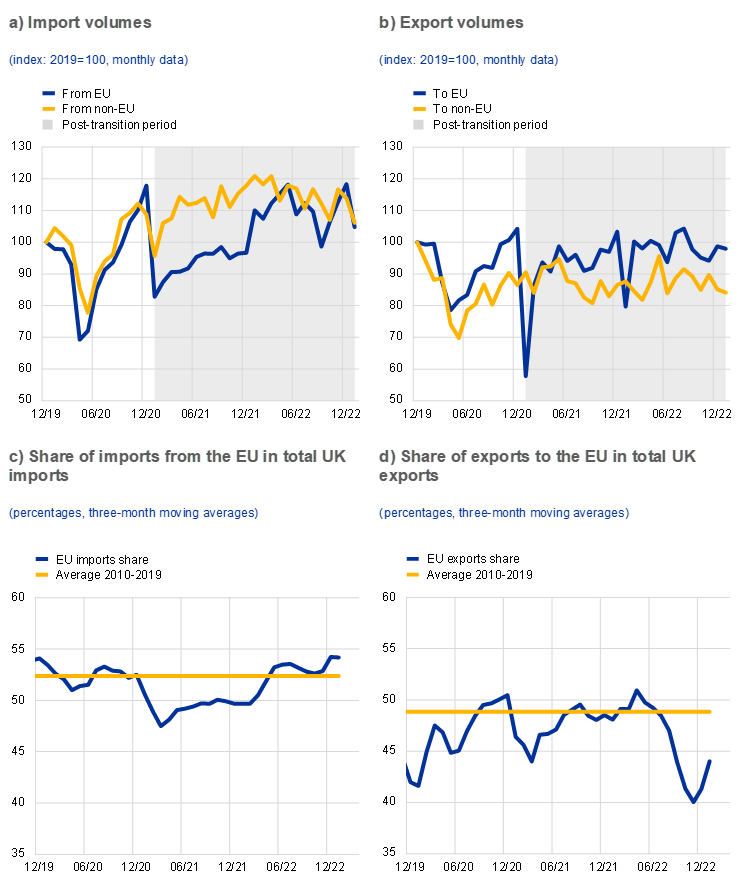

UK goods trading volumes with the EU fell significantly after the implementation of the TCA, remaining below their pre-pandemic level until the beginning of 2022. On the import side, despite the delayed application of TCA provisions by the United Kingdom, there was a striking decline in UK imports from the EU over the first months of 2021, which contrasted with a rise in goods imports from non-EU countries (Chart 1, panels a and c). This could point to some substitution between EU and non-EU imports, with goods being redirected away from transits via EU countries. However, different cyclical conditions during the pandemic (owing to differences in case numbers and restrictions) and different exposures to global supply bottlenecks may also have played a major role. As the gap between imports from EU and non-EU partners has closed over recent months, the impact of all these factors appears to have been rather short-lived. [4] On the export side, UK exports to EU countries fell sharply immediately after the introduction of the TCA, as many exporters were struggling to meet the new paperwork requirements for documenting compliance with EU standards (Chart 1, panel b). Subsequently, UK goods exports to the EU recovered somewhat and have since moved broadly in line with exports to non-EU partners, although they remain relatively subdued compared with pre-Brexit trends (chart 1, panel d). Brexit thus remains a major factor. According to a recent survey by the British Chambers of Commerce of more than 1,100 businesses to mark two years since the TCA was signed, 77% of firms trading with the EU said the deal was not helping them to increase sales or grow their business. More than half of the firms reported difficulties in adapting to the new rules for exporting goods (45% for services). [5]

UK trade in goods with EU and non-EU countries

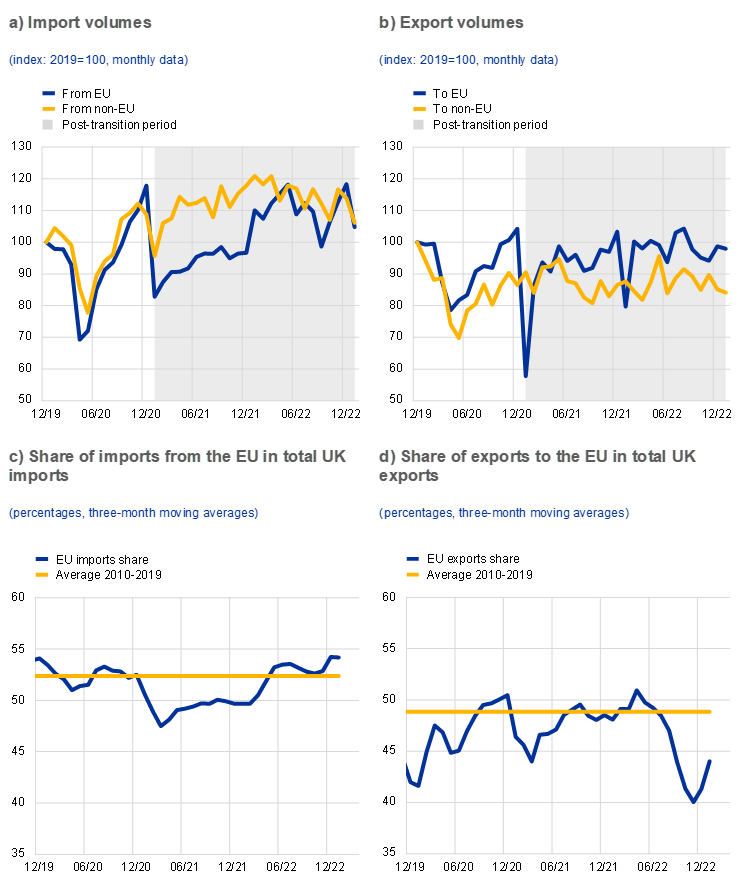

Services trade with the EU has remained somewhat weaker than trade with non-EU partners. Most of the initially stronger decline in services trade with the EU appeared to be pandemic-related, particularly given the higher share of the travel and transportation sectors in EU trade than in non-EU trade and the travel restrictions during the pandemic (Chart 2). Together with the recovery in tourism, UK services trade has bounced back, well exceeding pre-pandemic levels. This also reflects the post-pandemic increase in travel prices. Other important categories of services exports to the EU, such as financial services, fell further than, or failed to grow as much as, exports to the rest of the world until the end of 2021 and have remained below their pre-pandemic levels. Brexit thus appears to have played some role, possibly also owing to the lack of agreements covering trade in services. In the area of financial services, which account for around 20% of total UK services exports, the TCA’s provisions were limited. The United Kingdom and EU had agreed that, alongside the TCA, they would conclude a Memorandum of Understanding on regulatory cooperation, but this has still not been signed. Since Brexit, the importance of the EU as a UK trading partner has declined, with the EU accounting for 29% of total UK financial services exports in 2022, compared with 37% in 2019.

UK trade in services and UK services exports for selected sectors

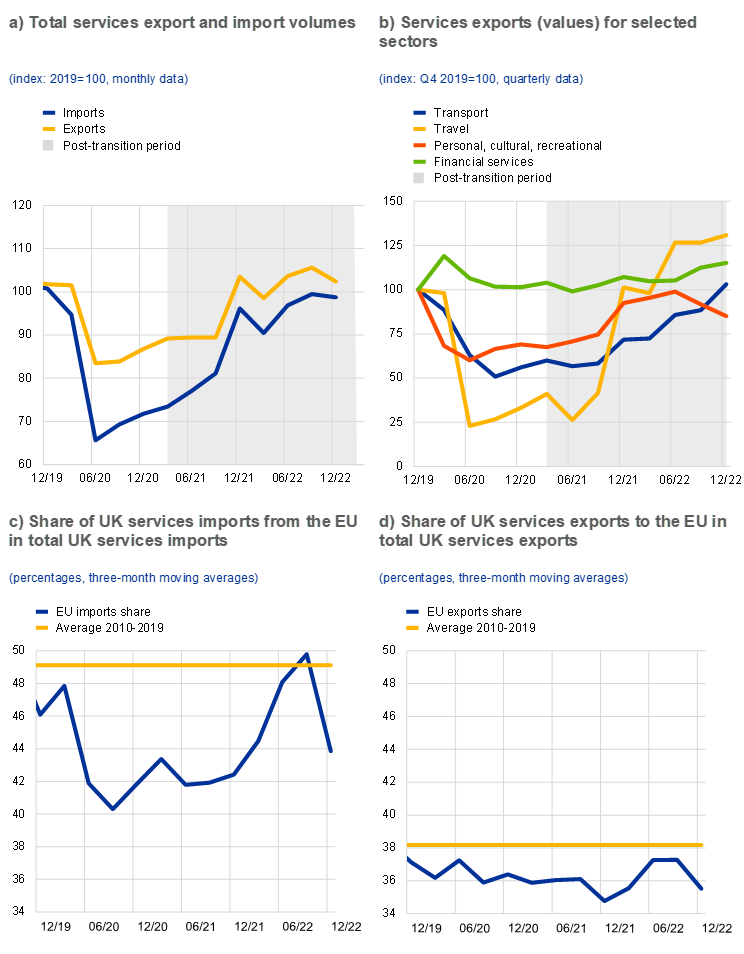

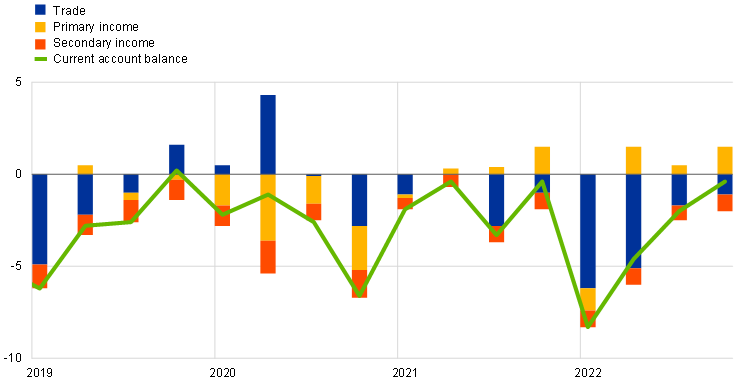

The UK current account deficit has widened since the implementation of the TCA, mostly driven by developments in the goods balance. In the first quarter of 2022, the UK current account deficit reached a record high of 7.7% of GDP, which was due to a worsening in both the trade deficit and the income balance (Chart 3). While most of the recent widening of the trade deficit could be attributed to high energy prices, the deterioration of the goods balance since the implementation of the TCA has generally been the main driver behind the developments in the UK current account. The services balance has remained fairly stable since the beginning of 2021, at around 6% of UK GDP, marking an end to the previously observed trend of rising surpluses in the UK services balance.

UK current account

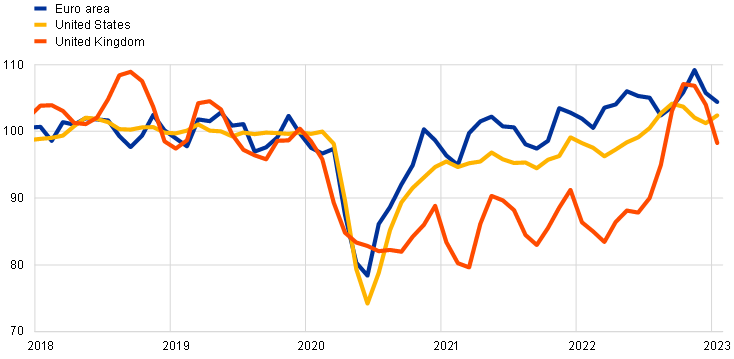

The post-pandemic recovery in UK trade has lagged behind that of other advanced economies. While the United Kingdom saw a collapse in exports that was similar to other countries at the start of the pandemic, it benefited much less from the subsequent recovery in global trade (Chart 4). By the end of 2021, other advanced economies’ exports had rebounded almost to their pre-pandemic levels, while UK exports remained around 10% below that level. As a result, UK trade as a share of GDP fell by 11% between 2019 and the end of 2021 – a significantly stronger decline than that observed in the euro area or the United States. By the end of 2022, the gap between UK exports and those of other advanced countries appeared to have closed, which may indicate that the disturbances linked to the Brexit transition period are dissipating. However, this needs to be interpreted with caution. Temporary catch-up effects from the pandemic and recent changes in UK trade statistics may also account for this development.

Goods export volumes in advanced economies

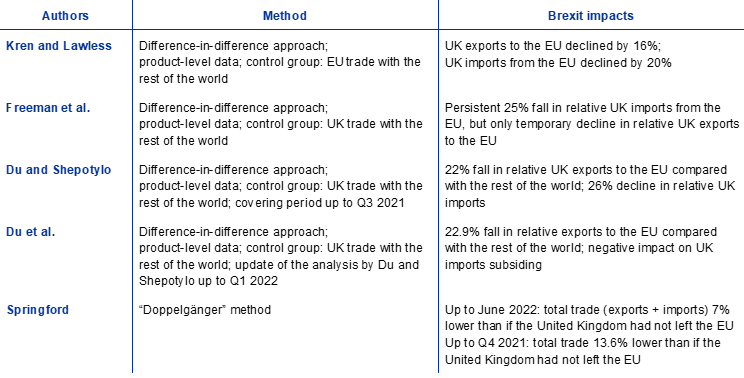

Two main approaches have been taken in the literature to isolate the impact of Brexit from pandemic-related effects. Various researchers have used a difference-in-difference approach, using different datasets and specifications. For example, Freeman et al., Du and Shepotylo, and Du et al. compare the evolution of UK-EU trade with UK trade with the rest of the world. Kren and Lawless, by contrast, use EU trade with the rest of the world as a comparison group. [6] Using high-frequency product-level data on trade in goods, a comprehensive set of product-time and product-partner fixed effects are applied to control for changes in trade patterns other than Brexit, in particular the changes in trade flows as a result of the COVID-19 pandemic. Following an alternative approach, Springford provided several updates of estimates of Brexit impacts using a “doppelgänger” method in which an algorithm selects countries whose economic performance closely matched that of the United Kingdom before Brexit. [7]

Taking into account the differences in methodologies, the available empirical evidence suggests that Brexit has reduced UK-EU trade in both directions. Table 1 provides an overview of recent results obtained using various approaches. Estimates of the decline in UK trade with the EU range from around 10% to 25%. [8] As the updates by Springford and Du et al. show, the results also depend on the time horizon being considered. As both UK and EU firms are still adjusting to the new environment, the gap between estimates may narrow again over time. Apart from providing estimates of Brexit effects since 2021, the available studies generally find no evidence of anticipation effects, i.e. a decline in UK-EU trade as a proportion of total UK trade prior to the provisional implementation of the TCA at the start of 2021. Across EU Member States, Brexit has led to a significant decline in trade with the United Kingdom in almost all cases, although at varying magnitudes. The decline has been most noticeable for those countries that historically accounted for a higher share of trade (i.e. trade in both directions with Ireland, exports to Cyprus and Malta, imports from Belgium and the Netherlands). [9] At the product level, it appears that there has been a substantial reduction in the number of products exported from the United Kingdom to the EU. The same is not found for exports of products from the EU to the United Kingdom. Overall, this is broadly consistent with the increased customs requirements on the EU side having a greater impact on low-value trade flows, often stopping such flows completely. At the same time, there has been an increasing concentration of export sales among fewer, larger exporters.

A selection of recent (i.e. post-Brexit) estimates of Brexit impacts on EU-UK goods trade

A comparison of these results with those from analyses performed prior to Brexit suggests that the initial impacts following the TCA have been more severe than expected. Ahead of Brexit, many Brexit scenario simulations were performed with different types of models, assuming different levels of tariffs and non-tariff barriers. [10] For instance, based on a New Keynesian DSGE model, which assumes a free trade agreement scenario for goods trade with the euro area similar to the terms of the TCA, it was typically expected that Brexit would lead to a decrease in total UK exports and imports (in the long run) of roughly 3%, with minor effects on goods exports to the euro area but more sizeable declines in services exports to the euro area. [11] The available evidence so far suggests that the initial adverse impact on UK goods exports has been more sizeable, indicating that UK exporters, at least initially, have been struggling to meet the increased administrative requirements following the introduction of customs checks at the EU border. As developments in services appear to have been strongly driven by pandemic-related factors, further analyses would be needed to disentangle the impact of Brexit from the impact of the pandemic on this sector. [12]

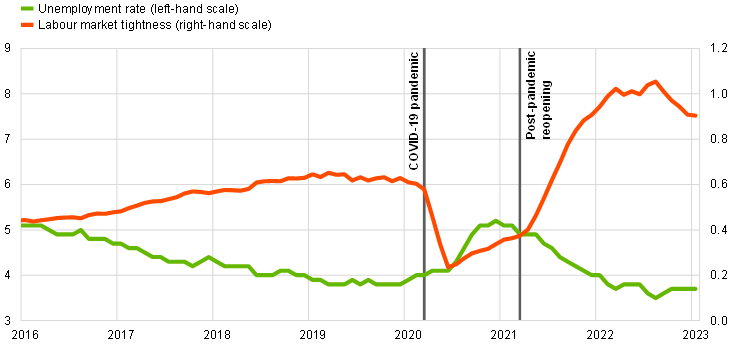

The UK labour market has become increasingly tight since the post-pandemic reopening, which also coincided with a fall in the number of EU migrants working in the United Kingdom. Following the post-pandemic recovery in demand in the second quarter of 2021, UK employers faced an unusually tight labour market, with a historically high number of vacancies and a low unemployment rate. Labour market tightness, measured as vacancies per unemployed person, has shown limited signs of easing, while companies have continued to struggle with recruitment difficulties (Chart 5, panel a).

Recent UK labour market developments

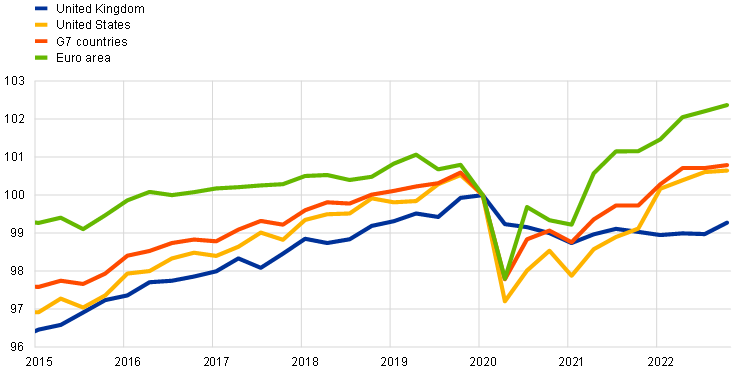

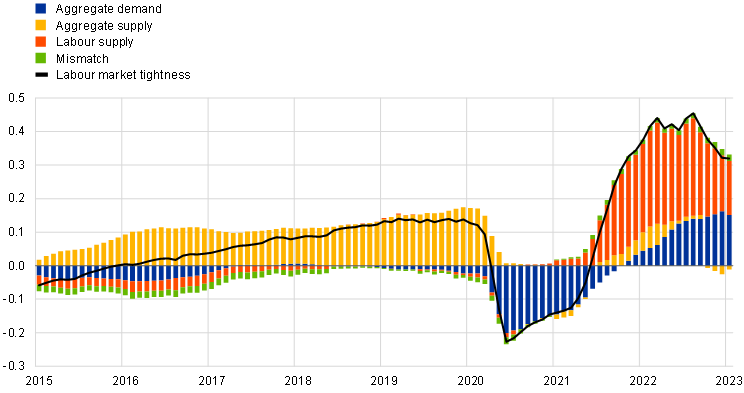

Weakness in labour supply has been the main driver of UK labour market tightness, while the surge in post-pandemic aggregate demand has played only a limited role. Many other advanced economies also experienced tight post-pandemic labour markets. In the same way as the initial collapse in aggregate demand at the start of the pandemic reduced recruitment of new workers, the reopening of the economy accelerated demand and encouraged companies to rehire staff. However, the persistence and the extent of labour market tightness make the United Kingdom an outlier, comparable only to the US economy. [13] One reason could be the sluggish recovery in UK labour supply, which has lagged behind other advanced economies (Chart 6). During the pandemic, many people became inactive, and, unlike the employment rate, the participation rate in the workforce has not reached pre-pandemic levels as the economy has recovered (Chart 5, panel b). A historical shock decomposition using a Bayesian vector autoregression (BVAR) analysis illustrates that the surge in UK post-pandemic labour market tightness can be attributed mainly to a smaller pool of available workers. While a faster than expected recovery was responsible for the initial rise in demand after the reopening of the economy, the analysis suggests that labour supply played a particularly important role. In contrast, aggregate supply constraints and labour mismatches appear to have been less significant (Chart 7). [14] The tightness of the UK labour market has therefore raised questions about the role of Brexit in UK labour shortages. The next section outlines the potential role of Brexit and changes in immigration policy in explaining these developments in labour supply.

Labour supply in advanced economies

Labour market tightness, BVAR historical decomposition

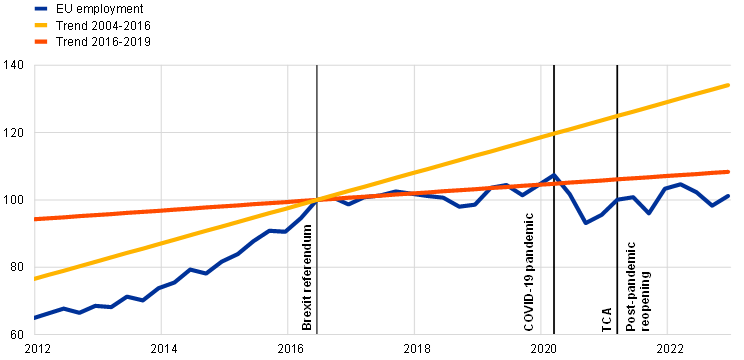

The Brexit referendum and the pandemic prompted a slowdown in EU employment growth as many EU workers found it less attractive to work in the United Kingdom. Prior to the 2016 referendum, successive EU enlargements had accelerated the movement of people between the United Kingdom and the rest of the EU. [15] The prospect of the Brexit referendum in June 2016 prompted a decline in EU net migration, as EU citizens found it less attractive to work in the United Kingdom. [16] The decline in new arrivals was accelerated by the onset of the pandemic in early 2020 and by the implementation of the TCA in January 2021. [17] The agreement introduced changes to UK immigration policy and ended automatic free movement for EU nationals not already settled in the United Kingdom. When looking at changes in the employment of EU citizens in the United Kingdom, it is evident that growth in such employment has slowed considerably since the Brexit referendum. A sharp fall at the onset of the pandemic was followed by a slow recovery in EU employment levels (Chart 8).

EU employment before and after the Brexit referendum

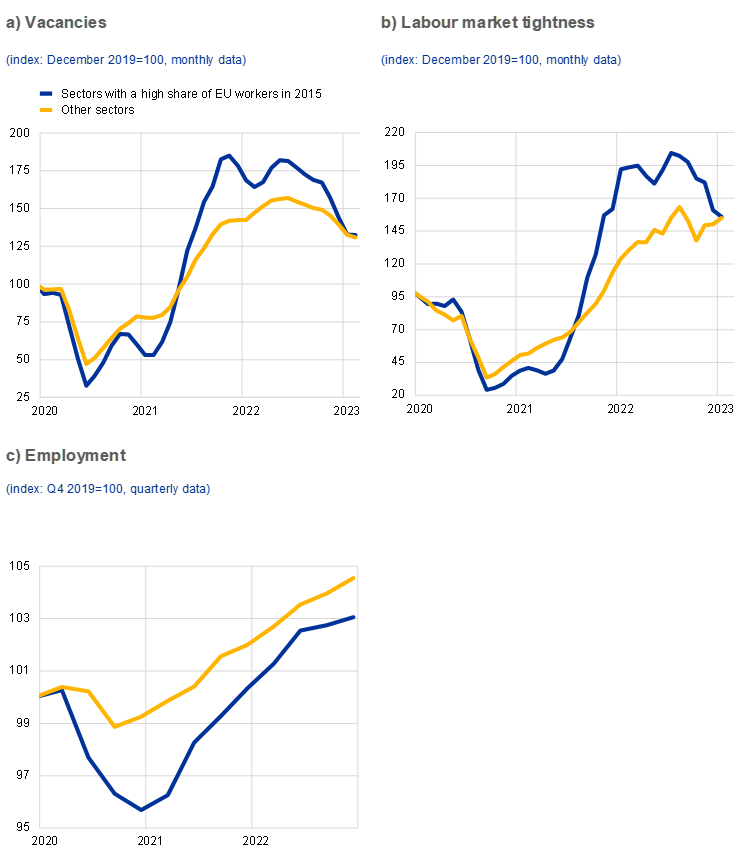

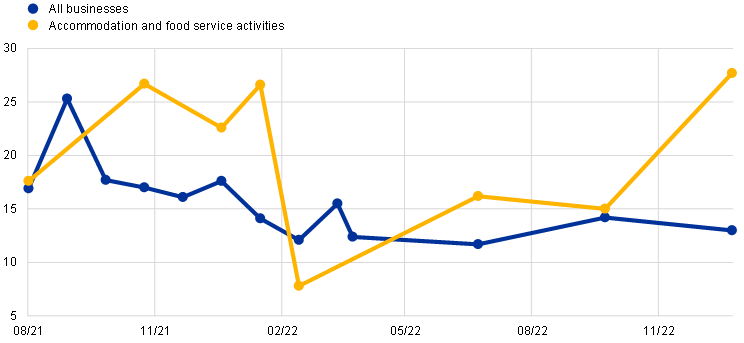

The rise in UK vacancies and labour market tightness has been greatest in sectors that relied most heavily on EU workers, but this can also be attributed to a sharp recovery in demand in the sectors most affected by the pandemic. In the second half of 2021 there were many reports of UK labour shortages, ranging from lorry drivers to healthcare and hospitality workers. [18] At first glance, the sharp rises in vacancies appeared to be limited predominately to the occupations and sectors that relied most heavily on EU workers before the pandemic, as increased demand for labour potentially reflected the reduced supply of workers from the EU. These sectors also experienced a sharper increase in labour market tightness (Chart 9, panels a and b). This might imply a decline in matching efficiency in these industries, owing to an increase in skill and sectoral mismatches between those seeking work and available jobs. [19] The implications of Brexit were underlined by survey data, as, on average, 15% of UK companies cited lack of availability of EU workers as one of the reasons for their recruitment difficulties. This was particularly evident for sectors which had a high share of EU workers before the pandemic, such as accommodation and food services (Chart 10). [20] However, these sectors were also the ones most affected by the pandemic, since EU nationals were overrepresented in contact-intensive industries, which experienced the largest fall in employment during the lockdowns (Chart 9, panel c). Along with Brexit, the rapid recovery in post-pandemic consumer demand can therefore also explain a rapid surge in vacancies and labour market tightness, as firms in these sectors struggled to rehire previously laid-off staff. [21]

Labour market developments in sectors with traditionally high shares of EU workers

Recruitment difficulties owing to reductions in EU applicants

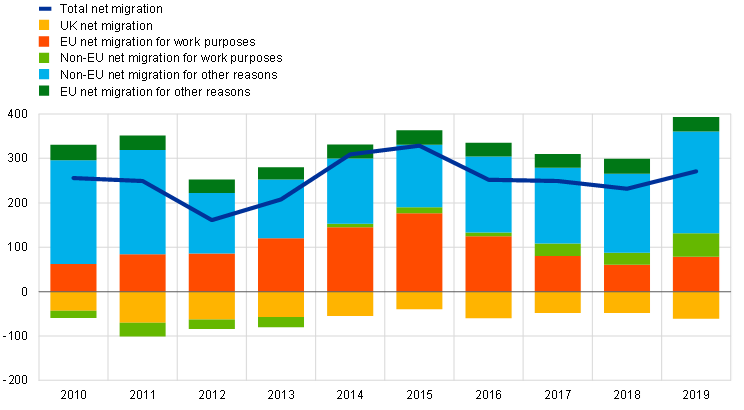

The slowdown in EU migration has to some extent been offset by an increase in non-EU migration. International migration was a key element in employment growth in most UK sectors before 2019. [22] Higher-skilled sectors recruited from both EU and non-EU countries, while lower-skilled sectors typically relied heavily on EU workers, given that lower-skilled workers from non-EU countries were generally not allowed to enter the UK labour market. [23] Following the Brexit referendum, the size of the EU migrant labour force began to shrink, while the share of non-EU employees was gradually increasing. The changes in total net migration indicate that by end of 2021, migration flows had returned to, or even surpassed, pre-pandemic levels. However, when only migrants seeking work are considered, the flows are much lower, albeit still relevant for labour market dynamics (Chart 11). [24] This raises the question of whether employers started to switch from EU to non-EU workers or whether the aggregate dynamics conceal asymmetries recorded at a sectoral level.

Net migration to the United Kingdom by nationality

While on average the rise in non-EU arrivals has more than offset the fall in EU migration, the new migration policy has reduced labour supply in some sectors. The new migration rules had a particularly negative impact on labour supply in lower-skilled sectors. The reversal in migration flows could be explained by the new immigration system that liberalised access to the UK labour market for skilled non-EU citizens, while requiring visas for EU nationals who had previously faced no restrictions. Work permits have become attainable only for those above a certain skill and salary level. [25] This made most lower-skilled industries, which had previously relied predominantly on EU workers, ineligible to issue work visas, and prompted an increase in non-EU migration, easing shortages in some sectors and occupations (Chart 12, panel a). Sectors driving the surge in employment of non-EU citizens were, in most cases, not the same as those driving the decline in employment of EU citizens. As new visa conditions made hiring of lower-skilled EU workers more difficult, the absence of these workers became particularly apparent in sectors such as accommodation and food services (Chart 10). Firms in the hospitality industry were thus initially not able to replace workers from the EU, although the industry has observed an increase in non-EU employment over the past year (Chart 12, panel b). [26] In contrast, some other industries, such as health and social work, have not been negatively affected by the new migration rules or have even benefited from the inflow of skilled non-EU workers (Chart 12, panel c). [27] While on average the rise in non-EU employment has offset the fall in EU employment, the new migration policy has reduced labour supply in some sectors. [28] Nevertheless, the evidence available so far suggests that changes in migration flows are only one of multiple factors contributing to an increase in labour market tightness.

UK employment by nationality

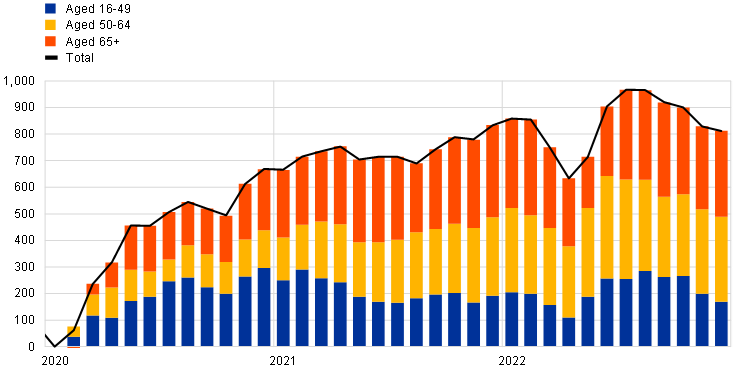

Brexit can only partially explain the weakness in the UK labour supply recovery, while an ageing population and pandemic effects appear to play an important role in explaining the decline in UK labour force participation. Changes in EU migration are not the only factor behind the recent changes in UK labour supply. Labour force growth had already started to decrease before the pandemic, as the United Kingdom’s “baby boomer” generation began to retire (as also observed in many other advanced economies), resulting in a marked shrinkage in the UK-born working-age population. Population ageing was countered to a certain extent by raising both male and female pension ages and through higher educational attainment, but the impact of these measures had largely dissipated by the onset of the pandemic. [29] Higher inactivity rates among those aged over 50 has contributed considerably to the increase in the inactive population (Chart 13, panel a). Other factors triggered by the pandemic have also contributed to the decline in labour participation. While the pandemic and prolonged waiting times for health services appear to have increased the number of people with long-term health issues among the inactive population, this increase is thought to be predominantly linked to individuals who were already inactive before the pandemic. When looking at flows out of the labour force, early retirement accounts for a much larger share (Chart 13, panel b). [30]

Other factors driving an increase in labour market inactivity

Almost two and a half years after the United Kingdom’s exit from the EU’s Single Market and the EU Customs Union, there is increasing evidence that Brexit has had negative effects on UK trade and the UK labour market. On the trade side, after controlling for pandemic-related effects, Brexit appears to have caused a significant decline in EU-UK trade in both directions, which, however, may recover to some extent over time, once UK and EU firms have fully adjusted to the new environment. The share of trade in GDP terms has also declined and a number of small and medium-sized UK companies have withdrawn from external trade with the EU. Regarding the labour market, there is evidence that the end of free movement for EU citizens has also contributed to the recent surge in labour shortages, particularly in sectors with lower-skilled workers. However, there have also been other, and potentially more important, drivers of the decline in UK labour force participation. Considerable uncertainty remains regarding the long-run impacts, including the extent to which the slowdown in EU trade and EU migration could weigh on potential labour supply and future productivity.